interest tax shield calculator

Interest Tax Shield Interest Expense Tax Rate. For instance if the.

Tax Shield Formula How To Calculate Tax Shield With Example

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution.

. This has been a guide to Tax Shield Formula. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

The Tax Shield FormulaThe Tax Shield Formula measures how much tax-deductible income you incur compared with your tax rateUsing the interest tax shield formula. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. No Matter What Your Tax Situation Is TurboTax Has You Covered.

How to calculate the tax shield. To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate. This gives you a good idea of the tax.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. No Matter What Your Tax Situation Is TurboTax Has You Covered. The interest tax shield is an important consideration because interest expense on debt ie.

And this net effect is the loss of the tax shield value but again of the original expense as income. The Present Value of Cash Flows pv cf is. The value of these shields depends on the effective tax rate for the corporation.

Capital budgeting techniques calculators By. Interest Tax Shield Formula. The tax rate for the company is 30.

The Present Value of Tax Shield pv ts is. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. The most important financing side effect is the interest tax shield ITS.

Lets understand this with the help of an example of a convertible bond. When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that. So the total tax shied or tax savings available to the.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Our Interest Calculator can help determine the interest payments and final balances on not only fixed principal amounts but also additional periodic contributions. Basically the company uses two main tax shield strategies.

Ad TaxInterest is the standard that helps you calculate the correct amounts. Accrued Interest Calculator Results. The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below.

The Adjusted Present Value apv is. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets interest on the debts etc and is calculated.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. Present Value of Cash. Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

The value of these shields depends on the effective tax rate for the corporation or. The interest tax shield helps offset the loss caused by the interest expense associated with debt which is why companies pay close attention to it when taking on more. The cost of borrowing is tax-deductible which reduces the taxes due in the current period.

Depreciation tax shield calculator. The impact of adding removing a tax. Interest Tax Shield Average debt.

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

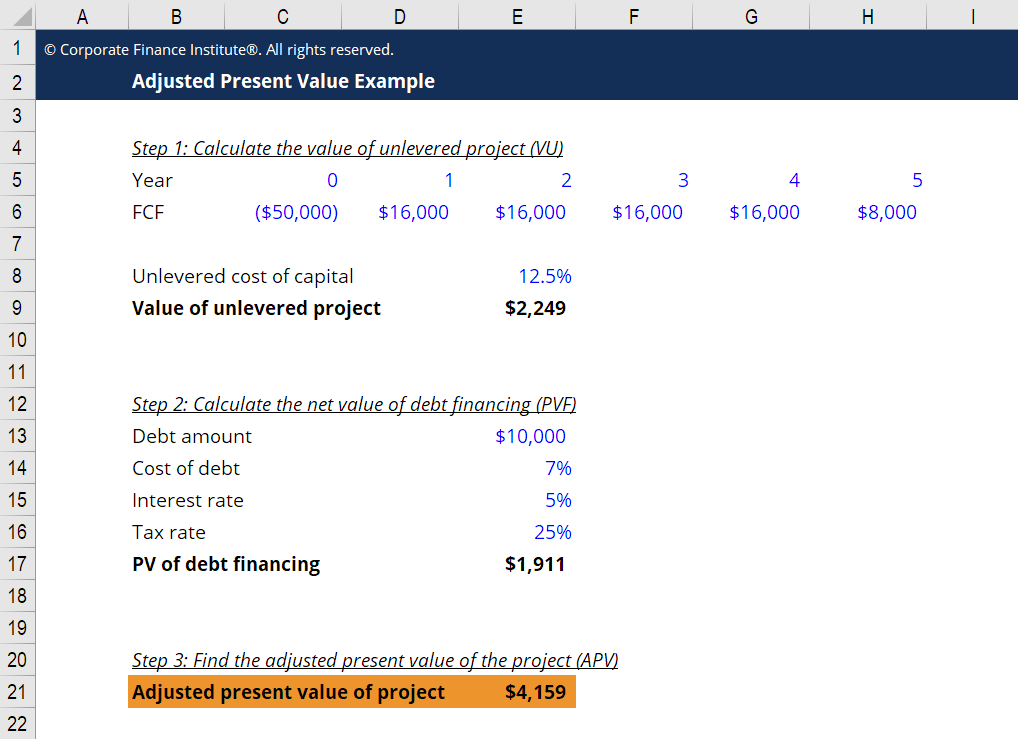

Adjusted Present Value Apv Formula And Excel Calculator

Interest Tax Shields Meaning Importance And More

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Adjusted Present Value Apv Definition Explanation Examples

Tax Shield Calculator Efinancemanagement

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Adjusted Present Value Apv Formula And Excel Calculator

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

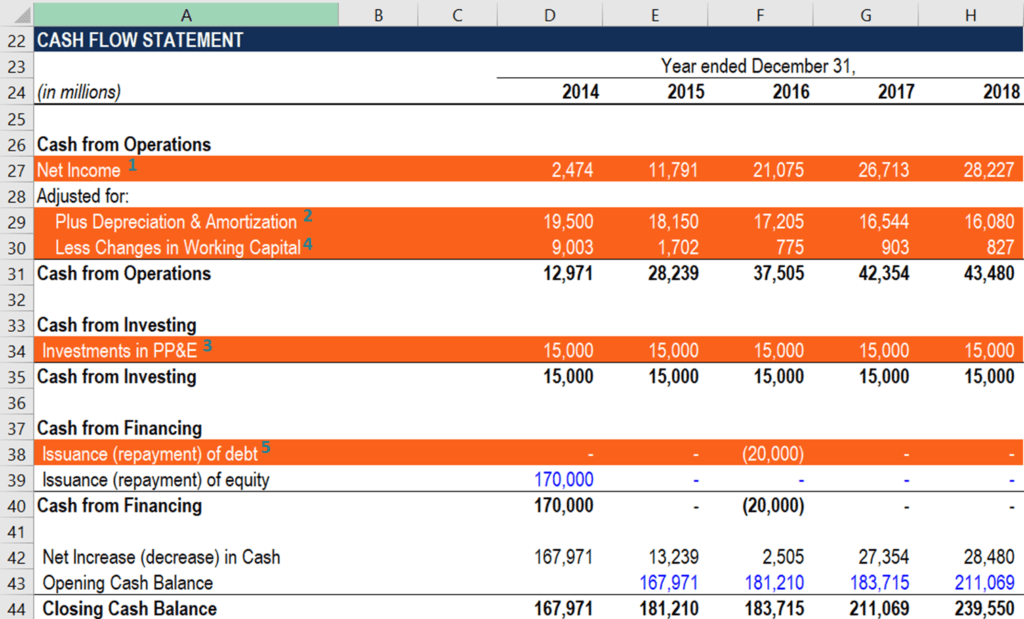

How To Calculate Fcfe From Net Income Overview Formula Example